- Get link

- X

- Other Apps

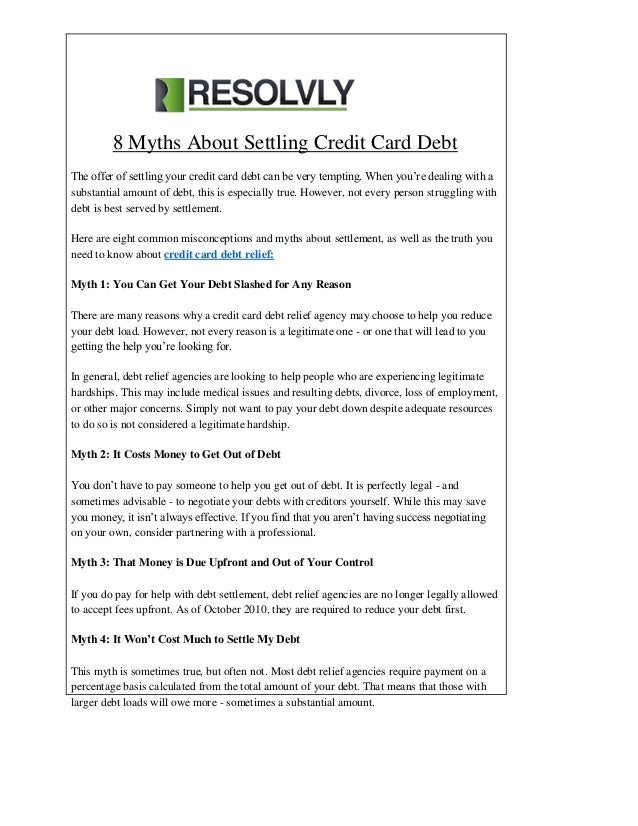

In most settlement terms they usually must not pay off credit card debts and transfer funds into an escrow account instead. A representative from the debt settlement company you work with will guide you through the process and present you with different options depending on your circumstances.

Best Ways To Deal With Credit Card Debts Blogfordarfur

Best Ways To Deal With Credit Card Debts Blogfordarfur

Settling your credit card debt is something thats often best left to a professional.

Best way to deal with credit card debt. Asking for someone in the collections and recovery department may be the most effective route to getting the right person on the phone. Then the company will speak with your lenders while the client accrues escrow funds. 1Pen down all your debts Get a clear picture of your finances.

In some cases filing for bankruptcy is a better way to deal with credit card debt. For people who have struggled with credit card debt personal loans can offer a good alternative. In addition to the NFCC you might also contact one of the following organizations for help with credit card debt.

Sometimes debt settlement is the only way to reasonably get out of substantial debt says Alan Nesbitt a financial counselor at financial literacy firm Clarifi. Another option if you have some money saved is to propose a credit card debt settlement. With this method you offer the card issuer one lump sum payment to.

These offer certified counselors trained in consumer credit money and debt management and budgeting. An assessment of your case can help you understand if this is the right option for you. You are allocating your.

Credit card discharge through Chapter 7. To help you take advantage of debt consolidation we walk through 7 easy ways to consolidate your credit card debt. This is the best option to file for if you absolutely think you cannot pay off your debt in a timely manner or if you owe more money than you can reasonably afford to repay.

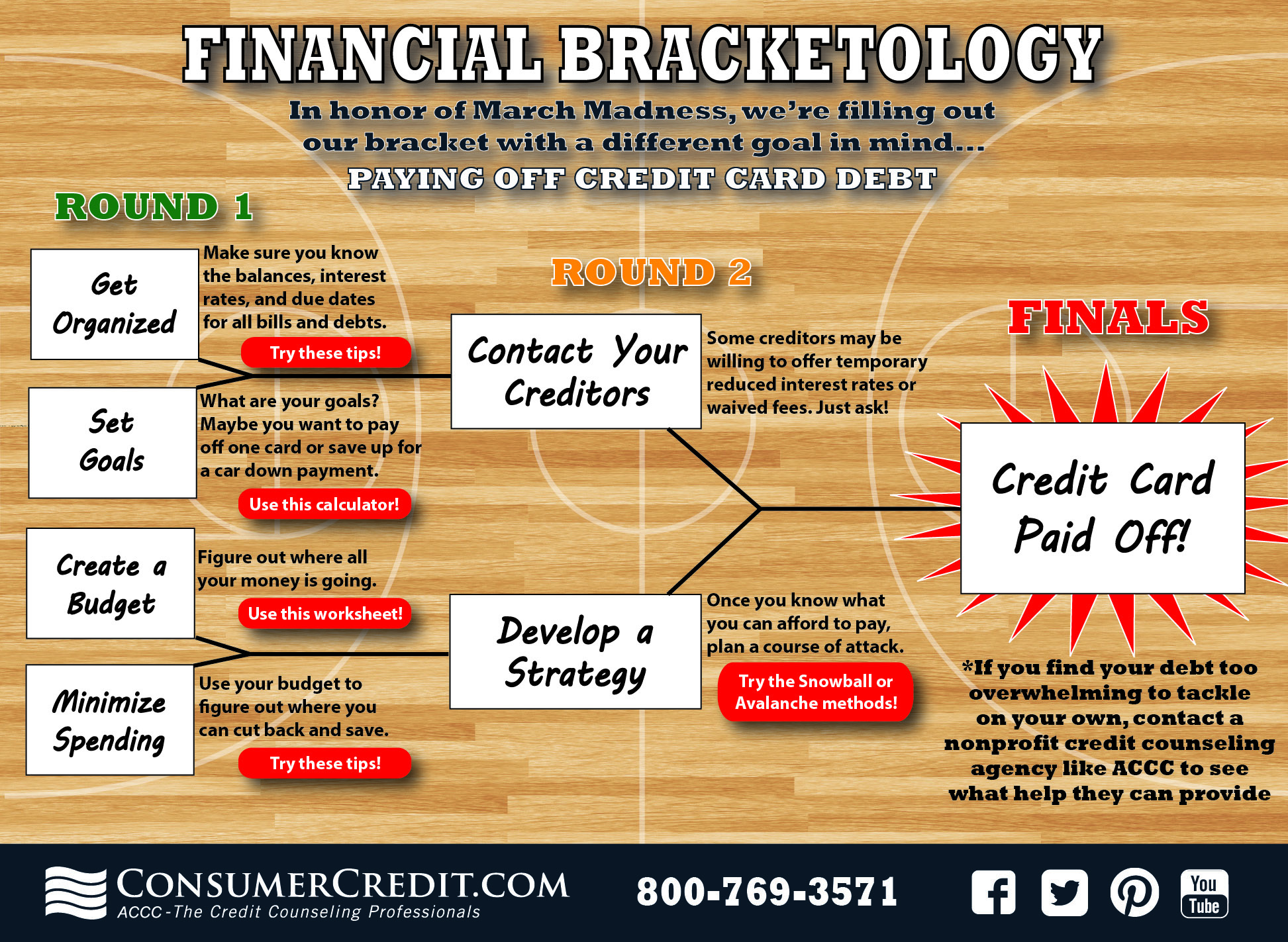

Loans typically have fixed terms of five years or. As an alternative to pursuing a debt settlement with your credit card issuers you could speak to a nonprofit credit counseling organization. Write down all your debts to know the exact figure of how much you owe.

Balance transfer credit cards typically offer an. Chapter 7 bankruptcy ensures that almost all credit card debt gets erased. Call customer service to negotiate credit card debt If your creditor hasnt already reached out to you you should reach out to them.

Consolidating debt can save money and time. This is especially true when dealing with high amounts of debt on multiple cards. How Counseling May Help With Credit Card Debt.

At the end of the process you will emerge to a more stable financial future. Here are a few tips to clear your Credit Card debt. If debt settlement succeeds the escrow money will be used to repay the reduced debt.

If your credit is in good shape you might also want to consider using a balance transfer credit card to pay down your credit card debt. This process allows for the discharge of certain balances while providing relief from debt collectors.

What Is The Best Way To Handle Credit Card Debt And Debt Repayment

What Is The Best Way To Handle Credit Card Debt And Debt Repayment

What S The Best Way To Manage Credit Card Debt Here Are 12 Self

What S The Best Way To Manage Credit Card Debt Here Are 12 Self

Debt Snowball Vs Debt Avalanche Paying Credit Card Debt Forbes Advisor

Debt Snowball Vs Debt Avalanche Paying Credit Card Debt Forbes Advisor

How To Get Out Of Credit Card Debt Real Simple

How To Get Out Of Credit Card Debt Real Simple

How To Pay Off Credit Card Debt Faster

How To Pay Off Credit Card Debt Faster

:max_bytes(150000):strip_icc()/exhausted-businessman-running-away-from-credit-card-170886185-5770a3ff3df78cb62ce6521c.jpg) Ways To Avoid Credit Card Debt

Ways To Avoid Credit Card Debt

Credit Card Debt How To Pay Dff

Credit Card Debt How To Pay Dff

10 Best Ways To Clear Credit Card Debt After Covid 19

10 Best Ways To Clear Credit Card Debt After Covid 19

How To Pay Off 10 000 In Credit Card Debt In Two Years My Story

How To Pay Off 10 000 In Credit Card Debt In Two Years My Story

How To Get Out Of Credit Card Debt Real Simple

Credit Card Debt Negotiation How To Negotiate Effectively Debt Com

Credit Card Debt Negotiation How To Negotiate Effectively Debt Com

How To Pay Off Credit Card Debt Fast Credible

How To Pay Off Credit Card Debt Fast Credible

Paying Off Credit Card Debt Consumer Credit

Paying Off Credit Card Debt Consumer Credit

How To Deal With Credit Card Debt Debtconsolidation

How To Deal With Credit Card Debt Debtconsolidation

Comments

Post a Comment